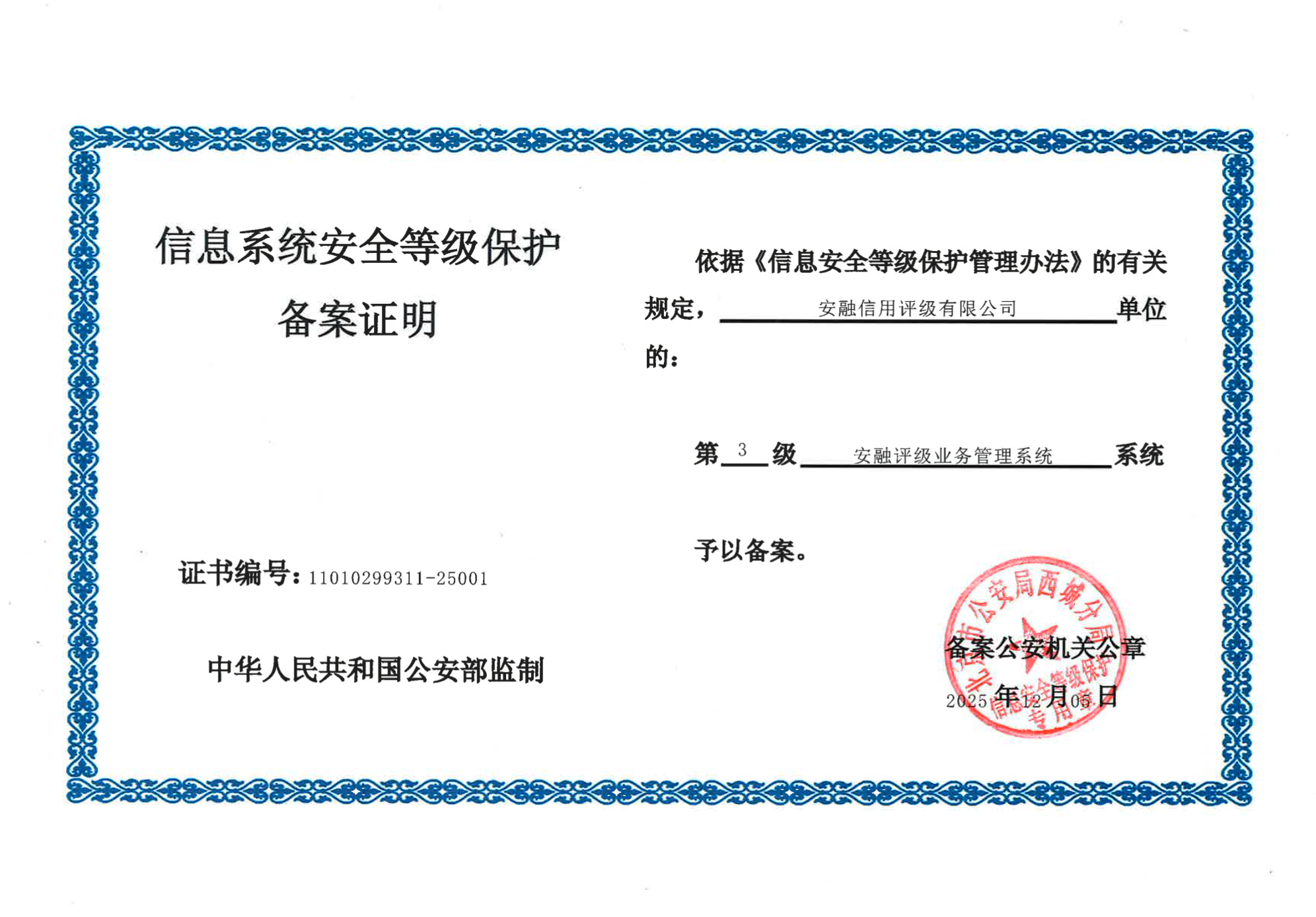

Anrong Rating Successfully Completes Filing for China’s Classified Cybersecurity Protection Level 3 (Supervised Protection Level) and Receives Filing Certificate Issued by Public Security Authorities

On December 5, 2025, Anrong Credit Rating Co., Ltd.’s rating system completed the filing for China’s Classified Cybersecurity Protection Level 3 (the highest level of national security supervision for critical information systems not involving state secrets) and obtained the filing certificate issued by public security authorities. The attainment of this vital qualification marks that Anrong Ratings has met the standards for information system security, including information security system development, risk management capabilities, and compliant operations. Anrong Ratings’ receipt of the Level 3 classified protection filing certificate is another milestone achievement in the field of information security management, following its ISO27001 Information Security Management System certification established by the International Organisation for Standardisation (ISO) in August this year, providing the company’s core business with dual “security certifications” that comply with both international and national standards. This is a strong return for Anrong Ratings’ long-term commitment to the deep integration of financial technology and information security, further consolidating the company’s professional image and market position in the credit services sector.

Information security is the lifeline of financial infrastructure. For credit rating agencies whose core competitiveness lies in information collection, information analysis, and data processing, ensuring the security, stability, and reliability of business systems is crucial.

According to the “Measures for the Administration of Classified Protection of Information Security” jointly issued by the Ministry of Public Security, the State Secrecy Bureau, the State Cryptography Administration, and the State Council Informationization Work Office, information system security protection is divided into five levels. Level 3 falls under the “Supervised Protection Level” and is the highest level at which the state conducts security supervision over critical information systems that do not involve state secrets. Achieving this level of filing means that Anrong Rating’s rating system meets the state’s mandatory security requirements for important information systems across multiple dimensions, including security policies, management systems, technical safeguards, and operations and maintenance assurance.

Anrong Ratings’ recent receipt of the Level 3 Classified Protection (MLPS) filing certificate is not only recognition of the security of its technical systems, but also a comprehensive validation of its overall security governance framework and organisational capabilities. For credit rating agencies, rating systems carry massive volumes of issuer financial data, market trading information, rating models, and analytical reports—information that directly affects pricing and risk assessment in financial markets. Passing the MLPS Level 3 filing brings multiple values to Anrong Ratings: first, it strengthens client trust by demonstrating a reliable ability to protect clients’ sensitive data from leakage, tampering, and destruction; second, it enhances operational resilience by establishing systematic security safeguards and emergency response mechanisms that effectively defend against cyberattacks and internal risks, ensuring the continuity and stable operation of rating services; third, it promotes compliant development—amid increasingly in-depth fintech regulation—by proactively meeting and exceeding regulatory requirements, paving the way for Anrong Ratings’ steady growth in the digital era; fourth, it highlights social responsibility, as an essential information service provider in financial markets—ensuring information security reflects its commitment to investors, issuers, and the market as a whole.

Looking ahead, Anrong Rating will continue to invest resources, dynamically optimise its information security management system, and actively address security challenges brought by new technologies. With safer, smarter, and more reliable rating services, it will further support the high-quality development of China’s bond market.